#002 The enterprise software you should pay attention to; a deep dive into Bytedance's Lark

By now we’re all well acquainted with TikTok (some of us more than others, for better or for worse ^_^). The sensational short-form video platform is the most downloaded app in the world and was first launched in 2016 as Douyin in China by a company called Bytedance. Today Bytedance is 8 years old and crowns itself as ‘the world’s most valuable startup’ after reaching a $75 billion valuation in Oct 2018. Bytedance is a mobile app factory, producing a family of apps that now reach over 700 million DAUs. Led by TikTok, its products are consumer apps and social platforms extremely popular among the Gen Z demographic. [Check out this extremely detailed TechNode report to learn more about its lesser-known apps.] The one outlier is an enterprise app called Lark. After being released last April, Lark went largely unnoticed by the world. In fact, Bytedance didn’t even host an official launch event or press conference for Lark. Then in February, Covid-19 forced over 200 million Chinese employees to work from home. Suddenly, Lark downloads skyrocketed, peaking at 22,000 daily downloads, and heads started turning: What is this thing, Lark?

Lark is an enterprise productivity tool that essentially combines the functions of Slack + Zoom + Google Docs + Trello. You can literally do everything on it — from team messaging to remote conferencing to document editing to workflow management. Available on all of macOS, iOS, Windows, and Android, Lark experienced 650% user growth after making its premium-tier of features available for free in response to the coronavirus shutdowns in China. For zero cost, companies get 100GB cloud storage per user, video calls with an uncapped number of participants, unlimited creation of online collaborative documents, and customizable attendance and approval management tools. Lark even connects with 3rd party software, including Jira, GitHub, Salesforce, and Google Analytics. The latest addition to its growing list of mini-apps is a partnership with Canva that allows users to instantly create, share, and edit design mock-ups.

Now that you know what Lark is, let’s discuss the bits I find most interesting.

[Lark was launched separately in China under the name Feishu, so don’t get confused if I use Lark and Feishu interchangeably.]

Bytedance + C̶o̶n̶s̶u̶m̶e̶r̶ Enterprise?

How did a company known for viral consumer apps end up releasing B2B software? Well Lark was originally incubated to serve as Bytedance’s internal communication tool after management found market offerings underwhelming. This may seem like a waste of company resources (why build when you can buy?) but developing in-house software to secure corporate data is actually a common practice among large Chinese tech firms. Major players like Baidu, Meituan, and JD.com all have their own messaging apps.

Anyways, after Lark graduated from the MVP stage, it was beta-tested extensively by the 50,000 employee-strong company, serving as a key tool for managing day-to-day workflow throughout 2017-2018. Run like a startup, it was updated 2-3 times a week, with many features being added, removed, and tweaked based on employee feedback. Then in Apr 2019, Bytedance decided to release Lark publicly in global markets, including the U.S., U.K., India, and Japan. Notice China’s exclusion. Bytedance probably thought Lark stood a better chance abroad, where there is an established culture of paying for enterprise software. This practice does not yet exist in China and local productivity tools are free-to-use, monetizing through other means.

In the year post-launch, Bytedance rapidly expanded its global team for Lark. It now has roughly 2,000 employees in offices including Singapore, London, and San Francisco. For an unproven app with little traction, this was a super aggressive hiring timeline, even for startup darling Bytedance. I suspect this may be tied in with its 2020 growth plans. Bytedance reportedly did $18 billion in revenue in 2019 and aims to grow that number to $25 billion this year by expanding into every remaining vertical of tech possible. The market for collaborative software grew to $16.5 billion last year, so a slice of this may be what’s motivating Bytedance to tip-toe across the line from consumer to enterprise.

Note that since this is Bytedance’s first attempt at enterprise software, it’s actually the first time the company is using a freemium model rather than monetizing through ads. That doesn’t mean that the consumer-focused company isn’t bringing its unorthodox consumer tactics to the world of enterprise SaaS. Out of the gate, Lark priced itself ridiculously cheap, costing just $2.50/user/month compared to $6 for G Suite, $6.67 for Slack, and $8.25 for Microsoft 365. And in recent months, its been giving away everything for free. Despite being a large global company, Bytedance is still a private startup and that means unlike competitors who are public and face investor scrutiny, it is under no pressure to make money from Lark immediately. This is simply an attempt at capturing a piece of the B2B market and makes up a small portion of their app portfolio.

Lark’s transformation from internal idea to 2,000-person team within a couple years is a reflection of Bytedance’s culture, best summarized by this post by Bytedance founder Zhang Yiming’s on Weibo (China’s Twitter equivalent). Bytedance’s rapid product development and iteration with a long-term goal of transforming each product into a standalone company is what fuels its success. Interestingly, this exact quote actually served as a banner on Lark website’s homepage for quite a long time.

The Chinese Enterprise Software Market

Enterprise productivity is unsurprisingly dominated by the usual tech suspects. Alibaba’s DingTalk is the oldest, with 200 million active users since launching 6 years ago, while Tencent’s Wechat Work has accumulated 60 million active users over the past 4 years. DingTalk is more popular among SMEs, while Wechat Work is more popular among large corporations — Tencent once claimed that over 400 of China’s top-500 companies use Wechat Work. The coronavirus outbreak may have seemed like the perfect storm for Bytedance to launch Lark/Feishu in China, but DingTalk and Wechat Work were still the two most downloaded apps on China’s App Store in Q1. Feishu only gained traction once Bytedance began offering its premium tier of services for free to match their competition’s free-to-use services.

Feishu fights an uphill battle to remain relevant against two competitors with unlimited resources, but I do think it has an advantage in competitive positioning. Once you open up Lark, it’s immediately clear that the refreshingly modern design must have been created by a team used to making consumer apps. Every button is in the right place and you can feel how this tool will make you work more efficiently. Xie Xin, the Bytedance VP who heads Lark/Feishu, recently explained on a podcast with GGV Capital that Lark was created to satisfy the ever-changing demands of modern companies. He believes that the tools we use shape the way we work. Since Lark was perfected over time to serve a fast-growing yet complex organization in Bytedance, it should therefore be a relevant tool for startups and large companies alike.

This positioning that focuses on the user greatly contrasts with the category’s incumbents. Take DingTalk for example. The app got popular because its features were designed to allow management to micro-manage workers. The most used feature is basically a digital punch card machine. Employees need to be within a specific location or connected to a specific wifi to punch in/out, and once activated, their GPS location data is uploaded to the system. Another popular feature is Ding. It is mandatory opt-in and allows the sender to ‘ding’ anyone who hasn’t read or responded to their message yet, which pushes additional notifications to the recipient to force a response. Not regular app notifications, but automated text messages and phone calls. You can imagine how much employees hate using this app. Since schools in China shut down, 50 million Chinese students were forced onto DingTalk as well and it seems like they didn’t enjoy it much either.

Horizontal vs. Vertical Strategy

The main difference between Lark and other enterprise productivity apps on the market is that apps like Slack and Zoom do one specific thing and need to be used in conjunction with one another, whereas Lark was designed to cover everything a business user needs to do. The obvious advantage here is that when data between different functionalities are interconnected, users don’t need to toggle through different programs and the tool becomes additive towards improving employee work efficiency. The obvious disadvantage is that it becomes difficult to convince customers to trust you with everything when they already have existing complementary solutions that meet their specific needs. Many teams are perfectly happy using Slack + Zoom. Plus, there is a huge switching cost to uprooting their entire workflow and migrating to another app.

The mentality for Bytedance to nevertheless build Lark horizontally is a function of the tech ecosystem composition in China, where few giants dominate the rest. Very generally, Alibaba runs e-commerce, Tencent runs social, and Baidu runs search. Regardless of what category you are building a product in, you will have no choice but to rely on proven distribution wedges to get to scale — channels that are controlled by the tech giants. For example, a consumer app finds it essential to integrate with Wechat’s mini-app platform because every user in China is on there. This creates a vicious cycle whereby relying on Tecent’s ecosystem only further empowers its network power and makes other companies more reliant on it. There’s a reason that DingTalk and Wechat Work are free-to-use — their sole purpose is to keep users locked within their respective ecosystems. If Lark only provided one service, say videoconferencing a la Zoom, there would be zero chance it could get users to leave the DingTalk interface and conduct video calls on a separate app. The unfortunate reality of tech in China is that the pinnacle of success for creating a Zoom-like app would be partnering with Alibaba to become the default videoconferencing app integrated into DingTalk. Across the tech landscape, the eventual one or two winners in each category are usually invested by or fully owned by one of the giants. Companies like Bytedance with its meteoric rise in Douyin are the exceptions that prove the rule. Bytedance can now promote Lark to its hundreds of millions of users because it has its own ecosystem of apps for distribution. If that’s the case, it makes perfect sense why Bytedance is building a horizontal platform that competes head-on against Alibaba and Tencent instead of focusing on one vertical.

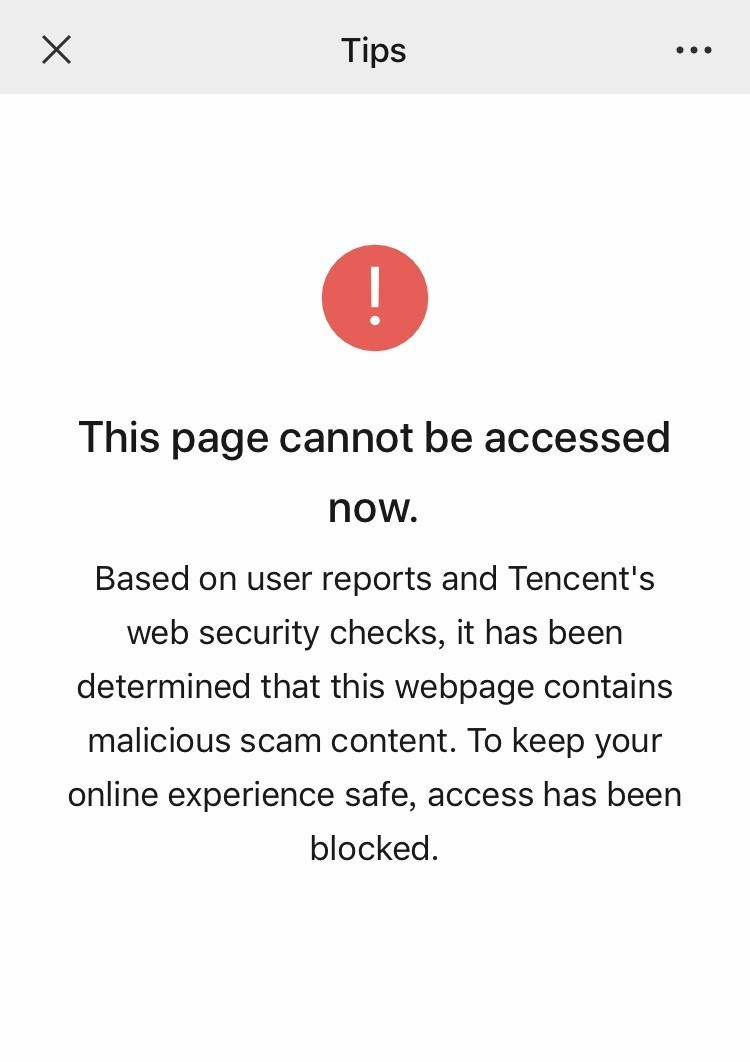

Oh yeah, remember when I said above that Tencent runs social with their superapp Wechat? Well turns out if you don’t play ball, you get kicked out of the ecosystem. Tencent feels threatened by Bytedance’s new app and as of last month has blocked all Feishu links from Wechat. This is a strategy Tencent uses often to flatten the growth curves of its competitors and ensure they don’t become popular. Bad news for anyone trying to send a group invite link or share access to a Lark document because this is all the recipient sees.

Proactive Unbundling

Throughout the last decade, horizontal platforms like eBay and Craigslist have been unbundled by startups that better serve users in one specific vertical. However, it must be rare for a platform to proactively unbundle itself into parts. Last month, Bytedance released Feishu Meeting, which is an app that only does videoconferencing, and Feishu Document, which offers collaborative document and spreadsheet editing. In the consumer space, Bytedance is known to throw everything and anything out there to see what sticks, so bombarding the app store with multiple options may be an extension of that strategy… OR it may be the ‘flywheel approach’ of using low switching cost products to lure in users before locking them in with high switching cost products. Elizabeth Yin write more about that about here

In addition to the unbundled apps, Bytedance also introduced Feishu Lite earlier this week. As the name suggests, its a lightweight version of the original app, focusing on just the core functionalities of messaging, videoconferencing, and document management. A cleaner UI provides a simpler user experience while still delivering most of the main app’s value.

[It was later reported that Bytedance released Feishu Lite because the Chinese government had banned Feishu from being downloaded for months due to it unintentionally allowing users to bypass the Great Firewall and access foreign news content. Releasing a similar app was Lark’s way of circumventing the App Store ban.]

The User Experience

Lark is honestly a tool that you must try for yourself to get it, because it replaces so many apps at once. The feedback I am seeing online and getting from people in my network for Lark is super positive. Every post seems to (rightfully) rave about the modern interface and ease of navigation. Space and Lemon, a startup foundry in Germany, posted a review on Medium after trying out the most popular work-from-home tools. From a lineup including Slack and Microsoft Teams, they enjoyed Lark the most:

Lark is not only our biggest surprise but also our absolute favourite among the tools. First of all, the graphical user interface is very clean and simple without missing anything. It looks like a better, more simplistic version of DingTalk. The main view includes a view of groups (similar to channels in Teams or Slack), mentions in documents (yes, you can directly tag persons and go to the tagged document, straight from the main feed), and private messages.

The video group chat works very well, with a good video and audio quality (some smaller lags, but rarely). One thing we did not like is that there is no overview of all participating users, seen often these days in screenshots of Zoom. The person who speaks (or someone who gets pinned by the moderator) is always full-screen, the rest is thumbnail-sized at the edge of the screen.

But our favourite feature is the “virtual office”. It is audio-only. Everyone who joins the “virtual office” can simply speak to all people in the room at all times. The microphone is disabled by default. The idea: to resemble the atmosphere of a real room where you can simply ask your colleagues for help or if they want to drink a coffee. If you don’t want to be disturbed, simply leave the room (“virtual office”) or go to another room.

Personally, I’ve been using Lark extensively after my team transitioned from Wechat to Lark, and I’m really enjoying not needing to switch between multiple apps. For example, during a group video call, documents can be dropped in the chat to instantly enable live collaborative editing. This makes it super easy for someone to get verbal feedback and document markups in real-time without needing Zoom and Google Docs both open.

Final Thoughts

Lark’s profile as a Chinese company amidst increasingly hostile US-China relations will make its global ambitions even harder to realize. Former YC partner Daniel Gross published this post on 2020 startup themes and mentioned Lark having the potential to exacerbate trade tensions between the two countries.

I find Lark very interesting. Lark is a mobile-first clone of Microsoft Office and Slack that quietly launched this year. Here’s the twist: it’s made by Bytedance, the Chinese company that created TikTok.

While far from perfect, Lark is surprisingly well built. What happens when it gets popular in the America? Will Microsoft / Google petition to ban it, the beginning of the Great American Firewall? Alternatively, how would success in China affect Microsoft Office revenue?

I believe the response from US tech companies is already well underway. Google is reportedly developing its own one-stop enterprise work platform by combining together existing Google productivity apps. Google also recently revealed data points for Google Cloud. Meet, its videoconferencing app, is adding 3 million new users per day and has grown 30x since January. Coupled with billions of users in the Google ecosystem, this is some tough incumbency for Lark to beat.

I also fully expect a discussion around data privacy to come up soon. Remember the uproar when Zoom was discovered to be routing data through Chinese servers? Officially, Lark is registered under a separate legal entity in Singapore and data is kept separately from Feishu. Lark’s data is stored on AWS servers, while Feishu’s data is kept in China. The caveat, however, is that Bytedance employees work on both Lark and Feishu concurrently, so there’s definitely overlap in who can access what.

My hot take is that Bytedance is going to build on the momentum that Feishu has created in China and push Lark aggressively in 2020, much like it did with TikTok in 2018. Following Feishu’s lead in China, Lark’s premium features are now also being offered for free in other geographies. Lark has global support offices already in place and has showed no signs of stopping its hiring spree despite the coronavirus. Bytedance has proven it knows how to build successful global products, and this time around has even more resources at its disposal. For the US specifically, a little digging on LinkedIn uncovers that Lark has been beefing up its engineering talent in the Bay Area with ex-Google and ex-Microsoft talent, apparently even hiring a founding engineer of Hangouts and Jamboard. It will definitely be interesting to see how the next 6-12 months play out.

Thanks for reading and don’t forget to subscribe!